In the fast-paced world of Revolutionizing automotive marketing solutions, the quest for success is a never-ending journey. Dealerships and marketing vendors, often hailed as strategic partners, have long grappled with the elusive concept of a value system. In this essay, we delve into the intricacies of measuring success in marketing efforts within the automotive industry and explore why the current methods may be flawed. Furthermore, at DTVMS, we propose a novel approach to gauge marketing ROI, fostering more productive partnerships between dealers and vendors.

The marketing problem for car dealers

One of the central challenges in the Revolutionizing automotive marketing industry lies in attributing success to specific actions. Dealers invest substantial sums in marketing, while vendors strive to provide impressions, views, and leads (read more here). However, drawing a direct line from a lead to a sale proves futile. In a complex ecosystem saturated with variables like impressions and views, isolating the root cause of a sale or lead becomes an exercise in futility.

The proposed solution to the marketing dilemma for car dealers

As a professional deeply entrenched in data interpretation, I propose a fundamental shift in our perspective on this issue. Instead of futilely attempting single-point attribution, we should acknowledge the straightforward value exchange at the heart of our industry: dealers entrust vendors with their marketing budgets, and in return, vendors furnish impressions, views, and leads (read more about this here)

Imagine the marketing budget as a pie, with each slice representing a specific aspect of the dealership’s marketing strategy. If a portion of the budget is allocated for lead generation, it should yield a commensurate number of leads. The same principle applies to views and impressions. For every dollar invested, there should be a reasonable return, akin to an equitable exchange for a slice of that budget pie.

How can we make it work for both dealers and vendors alike.

This perspective isn’t a critique of vendors; strategic partnerships are the lifeblood of our industry. However, clarity in defining and measuring the responsibilities of each party is paramount. Often, when the issue of attribution is raised, defensive walls go up, and challenges are made about the realism or validity of benchmarks. It is essential to transcend these barriers and engage in constructive conversations.

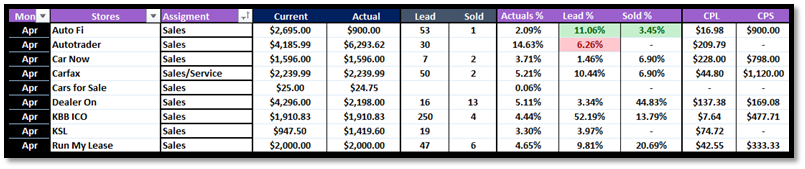

My team and I have diligently analyzed vendor data for years, encompassing monthly expenditures, impressions, leads, views, and appointment and sales data sourced from CRM systems. Using this data, we have devised a percentage-based evaluation process. For instance, If a dealership allocates 10% of its marketing budget to a specific lead provider, the expectation is at least a 10% return in terms of leads. The same principle applies to view and impression providers, encompassing various mediums such as OTT, TV, radio, and more.

We advise our dealer clients that a modest variance, say 0.20 percent, remains acceptable, recognizing certain limitations with this approach. For example, vendors cannot control appointments or sales, just as dealers cannot dictate lead or view quality. Nonetheless, some form of measurement is essential to evaluate performance; otherwise, dealers may continue to pay for advertising without holding vendors accountable for potential shortcomings.

Bringing it all together

Ultimately, we aim to create an environment where dealers and vendors can sit down, examine data that illuminates what truly contributes to success, and engage in constructive dialogues. A mutually agreed-upon benchmark will serve as the cornerstone of this collaboration. When dealers excel at selecting the right vehicles, pricing them competitively, and effectively merchandising, vendors must hold up their end of the value exchange.

The automotive industry’s success measurement methods demand reevaluation. By shifting our focus from elusive lead-to-sale attributions to an equitable exchange of budget slices, we can pave the way for more productive collaborations. This approach allows us to harness the power of data-driven decisions, ensuring that dealers and vendors alike can thrive in an industry that constantly evolves. Together, we can bridge the gap between marketing spend and attribution, steering the automotive industry toward a brighter, more prosperous future.